Buying your first home in 2025 presents a unique opportunity to secure your future and build equity. The market conditions and available financing options are dynamic, creating a need for a comprehensive guide. This guide will walk you through the essential steps of navigating the home-buying process in 2025, helping you avoid common pitfalls and achieve success. This detailed guide covers essential aspects from market analysis to financing solutions. Let’s dive into the essential steps.

Understanding the 2025 Real Estate Market

Analyzing Market Trends

The current real estate market in 2025 presents both opportunities and challenges. Homebuyers should conduct thorough research to understand the local market dynamics in their target area. This includes analyzing recent sales data, comparing home prices across different neighborhoods, evaluating average property values and neighborhood characteristics, and understanding recent trends like inventory levels, interest rates, and construction costs. This research will help buyers make informed decisions about price expectations and the timing of their purchase. For instance, identifying areas with increasing demand can highlight potential investment opportunities. A detailed analysis will allow buyers to strategically position themselves for success.

Assessing Financing Options

Understanding home financing options is critical to securing a mortgage. The availability of loans and the associated interest rates vary based on individual credit scores and economic conditions. Buyers should explore various mortgage programs, such as conventional loans, FHA loans, or VA loans, to identify the most suitable option for their financial situation. Consulting a mortgage broker or financial advisor to compare interest rates, loan terms, and associated fees can help buyers make informed decisions. A mortgage pre-approval is essential before actively searching for properties.

Preparing Your Finances

Budget Planning

Before entering the home-buying process, meticulous budget planning is essential. Home ownership comes with a wide range of financial responsibilities beyond the monthly mortgage payment. Buyers must anticipate and include projected costs like property taxes, homeowner’s insurance, maintenance, and potential repairs. Creating a detailed budget helps you determine your affordability and avoid overspending or taking on more debt than you can comfortably manage. Consider developing a budget that outlines monthly costs and accounts for potential emergencies, allowing for unexpected expenses. A detailed budget should include a realistic assessment of existing debts, anticipated income, and monthly expenses.

Securing Financing

Securing a mortgage involves the pre-approval process, where lenders assess your creditworthiness and determine your borrowing capacity. This process involves providing necessary financial documents to the lender, which then determines the maximum mortgage amount you qualify for. The pre-approval letter acts as a crucial tool for negotiation. By knowing your pre-approval amount, you will have a clear picture of how much you can afford and will be prepared to compete effectively during negotiations.

Finding the Right Property

Identifying Your Needs

Identifying your needs and priorities before house hunting is crucial. This involves considering factors like desired location, home size, number of bedrooms and bathrooms, amenities, and style. A clear understanding of personal preferences will help you to identify properties that align with your needs and expectations. Consider what’s most important to you—close proximity to work, amenities such as a park or shopping center, or the school district in your desired community? This should be clear before starting your search. Conduct thorough research to identify local markets and trends within the chosen neighborhood.

Evaluating Potential Homes

Once you’ve identified your needs, start exploring potential homes. Visiting different properties will allow you to compare and contrast various options. Carefully evaluate each property, paying attention to crucial aspects, such as the condition of the house, its design, its location, and the potential for future renovations. During the visit, evaluate the condition of the property, paying attention to any signs of damage or potential maintenance concerns. Take detailed notes and document any issues during the walkthrough.

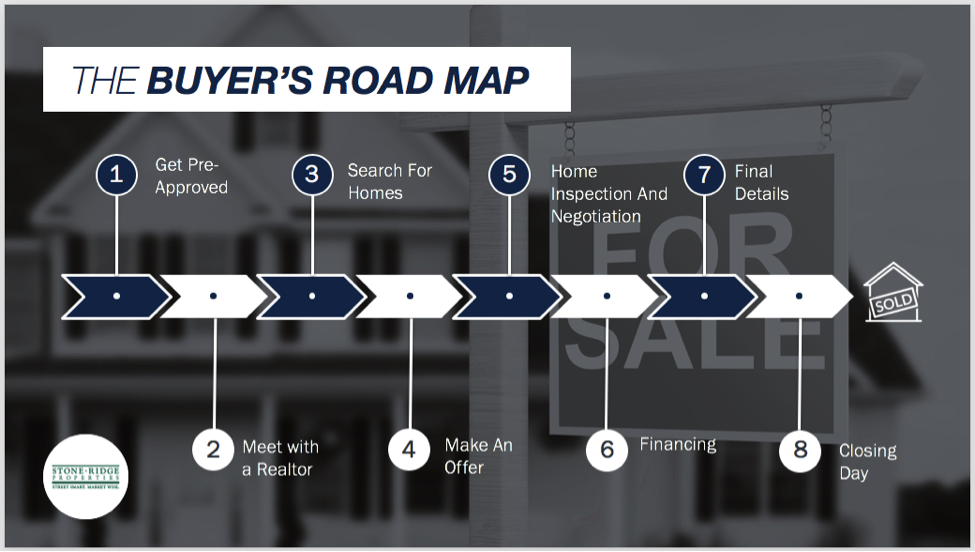

Navigating the Home-Buying Process

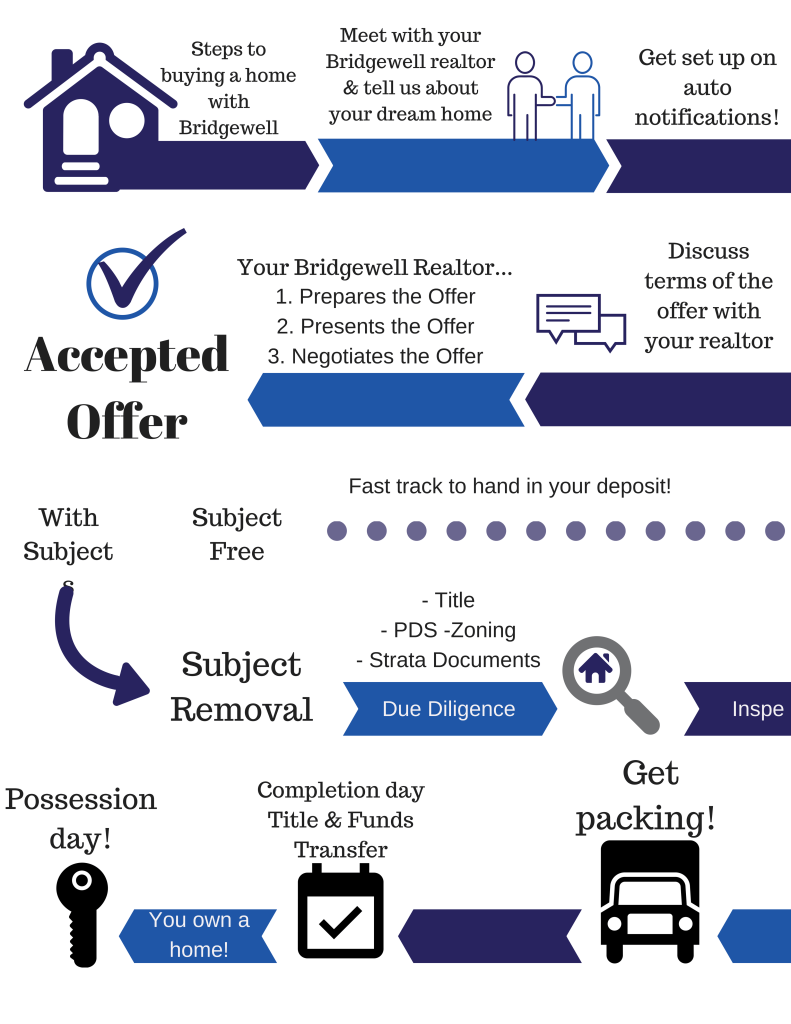

The Offer and Negotiation

After identifying suitable properties, crafting a strong offer is crucial. This involves setting a realistic price range that aligns with the market value, and includes contingencies such as appraisal and financing. Engage in negotiations to secure the most favorable terms. A qualified real estate agent can assist in this process, offering valuable guidance on negotiating strategies. Determine the appropriate offer price, taking into account the property’s appraised value, comparable sales in the neighborhood, and your pre-approval amount.

The Closing Process

The closing process involves numerous tasks, including finalizing financing, securing title insurance, and completing the necessary paperwork. Understanding the responsibilities of each party involved in the transaction is essential. A qualified attorney or real estate agent can provide clarification on each step. This process involves coordinating with the lender, real estate agent, and the title company to ensure a smooth closing. This process typically culminates in the exchange of funds and the transfer of ownership.

Key Considerations for 2025

The Impact of Market Trends

Understanding the current market trends in 2025 is essential for both buying and selling your first home. Factors like interest rates, inventory levels, and economic conditions significantly influence market dynamics. This means you should be aware of how these factors affect your budget and the overall home-buying experience. Staying up to date on market trends will allow for strategic decision-making and a comprehensive approach to navigating the home-buying process.

Maintaining a Realistic Approach

Maintaining a realistic approach to home buying is vital. By considering market conditions, personal financial situations, and individual needs, buyers can make informed choices. Understanding your financial capabilities and the current market conditions will allow for a more strategic decision-making process.

Legal Considerations

Due Diligence

Before finalizing the purchase, due diligence is essential. This involves conducting thorough research and inspections. Property inspections should cover all major systems and structures, including the roof, plumbing, electrical system, and foundation, to uncover any potential issues. This allows for addressing concerns before finalizing the purchase. Thorough due diligence ensures that you understand the property’s condition and allows you to negotiate repairs or credits based on discovered issues.

Closing Costs

Realize that the closing process comes with various expenses beyond the purchase price. Be prepared for closing costs which can include the appraisal fee, title insurance, recording fees, attorney fees, and other expenses. These costs should be part of your budget. This includes a clear understanding of all associated costs to manage expectations and avoid surprises.

Beyond the Basics

Building Equity

Acquiring your first home is a critical step toward building equity. Understanding home appreciation and how your investment grows is vital. This includes developing a long-term plan for homeownership, including factors such as possible renovations, the potential of increasing property value in the future, and the potential costs of maintenance. A long-term view will allow you to strategize to build and maintain equity in your investment.

Home Maintenance

Maintaining your home involves a proactive approach to prevent potential issues. This entails scheduling routine maintenance for essential home systems, such as HVAC, plumbing, and electrical systems. Regular home maintenance is key to avoiding more significant expenses in the future. Identifying potential problems early will help you reduce your future costs.

FAQ

What are the common pitfalls to avoid when buying your first home in 2025?

Many first-time homebuyers face challenges due to a combination of inexperience and unfamiliar territory. A lack of knowledge about the home-buying process, misinterpreting market trends, and overlooking critical financial factors can hinder success. For example, a buyer may overestimate their affordability or overlook the importance of thorough home inspections. It’s crucial to research your local market, understand lending criteria, and carefully review all documents before signing any contracts. Another critical pitfall is not seeking professional advice from a real estate agent and financial advisor who can offer guidance and protect your interests.

How do I know if I am financially ready to buy a home in 2025?

Before starting the home-buying process, thoroughly evaluate your financial situation. Calculate your monthly expenses and determine your potential mortgage payments. Evaluate your savings and understand the down payment requirements. Research different financing options and compare interest rates. Getting pre-approved for a mortgage is a crucial step, and you should determine what your budget is before contacting a realtor to tour potential properties. Review your overall financial health by establishing a solid monthly budget, including variable and fixed expenses. By considering these factors, you’ll be better equipped to make informed decisions throughout the home-buying journey. Crucially, consult a financial advisor to understand your long-term financial goals and ensure that buying a home aligns with those goals.

What are the key considerations for choosing the right home in 2025?

In conclusion, buying your first home in 2025 requires careful planning, research, and a realistic approach to home financing. By understanding the current market trends, researching financing options, and prioritizing your needs, you can navigate the process successfully. This guide provided a comprehensive overview of the steps involved. To take the next step, consider scheduling a consultation with a qualified real estate agent or financial advisor. Contact us today for a free consultation to explore the best financing options available to you! Consider attending a real estate workshop to learn more about the industry and connect with professionals. Your dream home awaits!